Export restrictions have been another driver, yet with zero capital gains over this two-year time period, shares have actually been an outperformer. The same reversal in all these items has brought shares back to $125 now, or $500 ahead of the split, marking zero returns vs. This marked shares nearly tripling from September 2020 amidst very strong market conditions, a boom in valuations and cryptocurrencies. With the benefit of hindsight I have been far too cautious as Nvidia participated in the massive 2021 rally as well as shares peaked near $350 per share, that's after the split in the summer of that year, corresponding to a near $1,400 price level ahead of the stock split. Despite this huge momentum, valuations were very demanding at over 50 times earnings, too demanding to get involved. Valued at just over $300 billion in September, the company traded at 17-18 times sales as the annual run rate in terms of sales had risen to about $16 billion at the time with earnings coming in around $9 per share. Trading at $500 at the time, these were nose-bleed valuations, but momentum already was improving ahead of the pandemic. A $9 billion net cash position was equal to about $15 per share. To put some perspective we have to look at some fundamental numbers as the company posted its fiscal 2020 results early that year, with sales down 7% to $10.9 billion amidst the pullback in cryptocurrencies, as adjusted earnings fell 13% to $5.79 per share.

With a mere $1.8 billion revenue contribution, albeit accompanied by steep 35% EBITDA margins, it's safe to say that valuations for ARM were very high, but this as a strategic deal as well, and was actually applauded by the market.

Ever since we have seen a four-for-one stock split in 2021, so that $500 level at the time is equivalent to $125 today.Ĭoming strong out of the initial setback of the pandemic, Nvidia announced a huge $40 billion deal for ARM in September 2020, to further enforce its dominance in AI computing, while riding the wave of other megatrends as well including the cloud, smartphones, self-driving cars, robotics, etc.

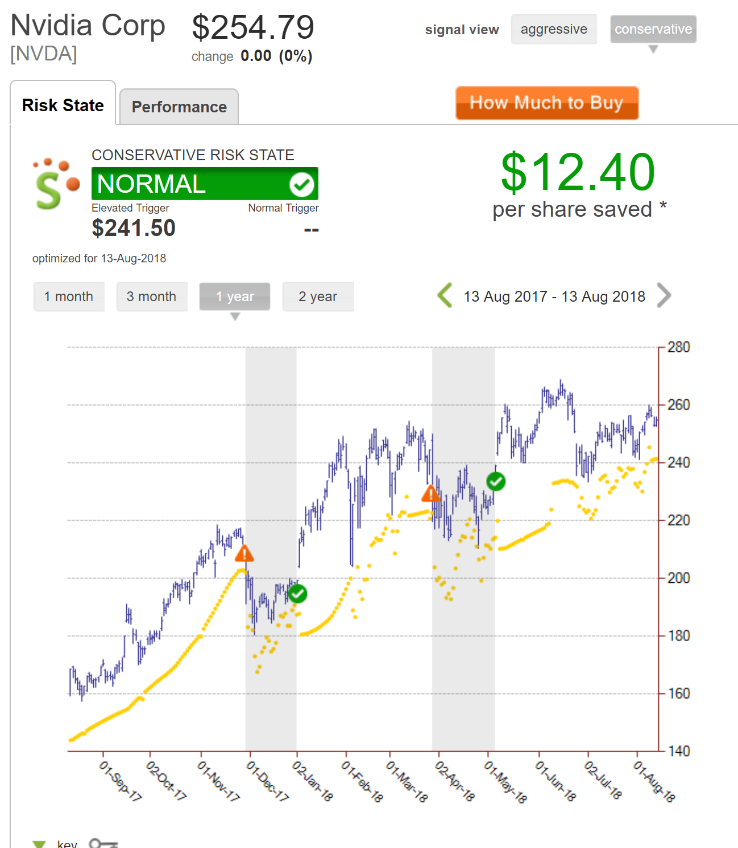

A $30 stock rallied to $300 in 2016/2018, suffered a setback amidst a pullback in crypto, but rose to $500 in September 2020. Nvidia has seen great momentum over the past decade driven by impressive leadership, great positioning and decisive dealmaking at times. In the article called ¨With and without ARM¨ I saw the strategic rationale and a savvy deal structure behind the transaction, yet I was wary of the nosebleed valuation at which the company was trading, as little could I have known what was set to happen in 2021. Two years ago, I last reviewed shares of Nvidia ( NASDAQ: NVDA) at a time when the company was seeing incredible momentum coming out of the outbreak of the pandemic, at a time when it was willing to spent $40 billion to acquire ARM.

0 kommentar(er)

0 kommentar(er)